Net pay calculator with overtime

While some people think hourly jobs pay a lot less than salaried work its not always true. How to Calculate Overtime on a Semi-Monthly Pay Period.

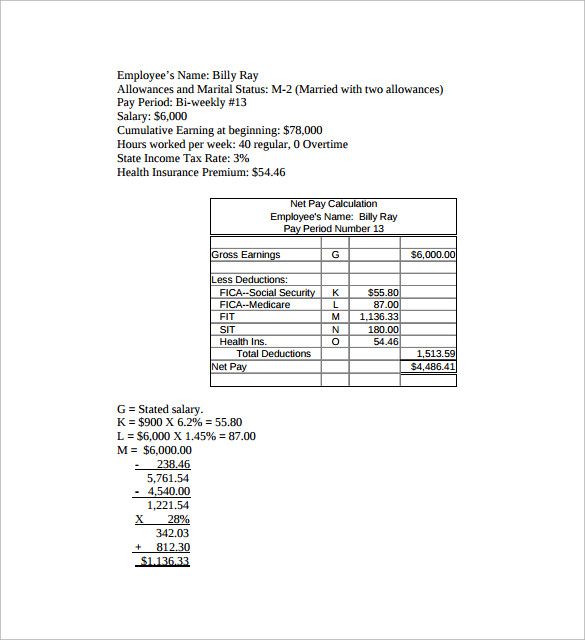

How To Calculate Net Pay Step By Step Example

Non-exempt employees are employees that are entitled to minimum wage as well as overtime pay under the FLSA.

. Use the Pay Raise Calculator to determine your pay raise and see a comparison before and after the salary increase. Fill up the data Press Calculate button below and we will do the BIR TRAIN Withholding Tax. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

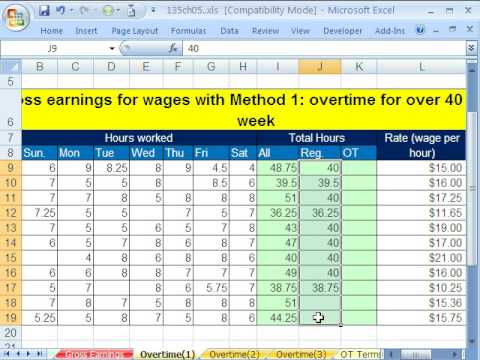

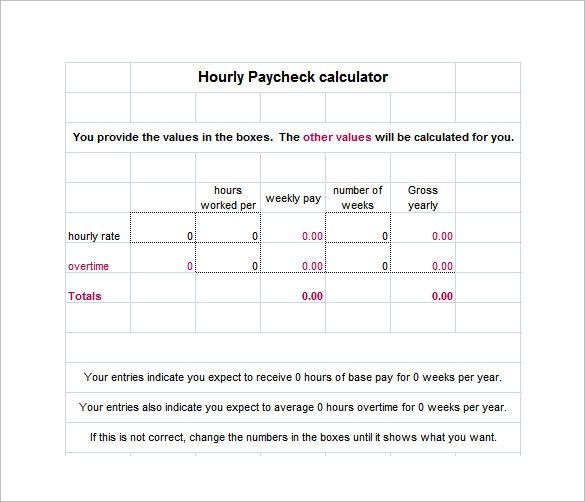

Calculate the gross amount of pay based on hours worked and rate of pay including overtime. In all cases to calculate the employees net pay the amount to subtract from gross pay is determined by using the number of deductions declared by the employee on the W-4 form. Exclusions exemptions from the overtime pay regulations follow the federal Fair Labor Standards Act FLSAHowever the minimum weekly salary that must be paid on a guaranteed basis to an employee who is classified as exempt under the executive and administrative employee exemptions is higher than the federal minimum of 455 per week 684week as of.

Enter your current pay rate and select the pay period. Top Jobs That Let You Benefit from Overtime Pay. This calculator is always up to date and conforms to official Australian Tax Office rates and formulas.

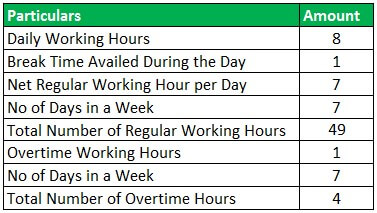

Enter times in the row for Day 1 as 835 1237 107 245 305 and 500 or just 5. If you pay overtime for more than 40 hours per week enter any carryover hours due to a partial workweek in the last pay period. 2022 Philippines BIR TRAIN Withholding Tax Calculator.

Full time working is anyone who works 375 hours a week. OECD figures show Australians had a net average tax rate of 236 in a recent year. 2011 51 Cal4th 1191 1206 The California Labor Code does apply to overtime work performed in California for a California-based employer by out-of-state plaintiffs in the circumstances of this case such that overtime pay is required for work in excess of eight hours per day or in excess of 40 hours per week.

Enter this handy calculator which I hope helps you sort things out whether you are full-time part-time overseas pondering that. It can account for various overtime situations. For more information about overtime non-exempt or exempt employment or to do calculations involving working hours please visit.

Then enter the employees gross salary amount. However many employees work unusual shifts and go above and beyond this standard. If you work any time over 375 hours you will be paid one and a half 15 times your normal hourly rate.

The additional three hours of retro pay not only need to be paid but paid at 15 times the regular pay rate as they are calculated as overtime in the prior pay period. If you work in the NHS and are full time you are entitled to be paid NHS overtime rates. At last the timesheet calculator will automatically give you the total hours you worked with your salary.

The calculator will update the total each time you enter a new InOut pair of times. These are used in conjunction with the tax charts provided by. Summary report for total hours and total pay.

Bonuses commissions pensions rent overtime payments work allowances and interest from bank accounts each. It is a systematic approach. Sweldong Pinoy is a salary calculator for Filipinos in computing net pay withholding taxes and contributions to SSSGSIS PhilHealth and PAG-IBIG.

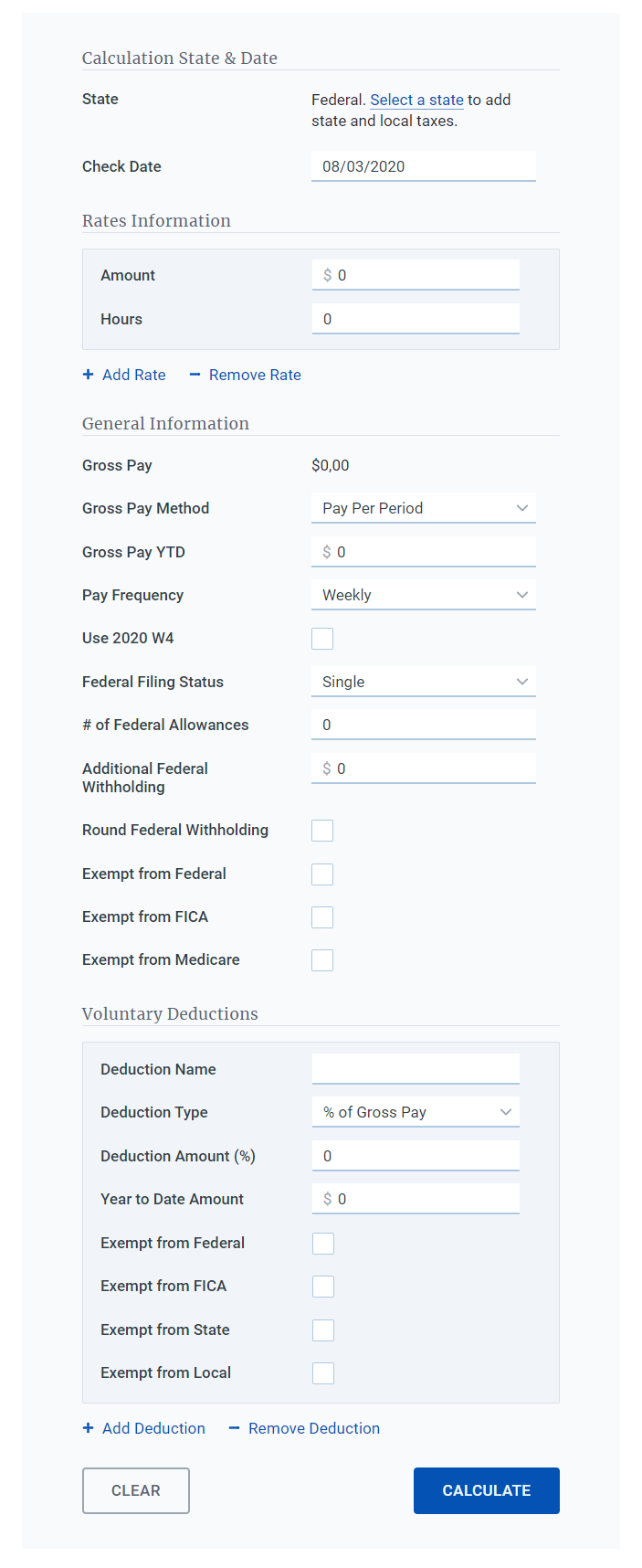

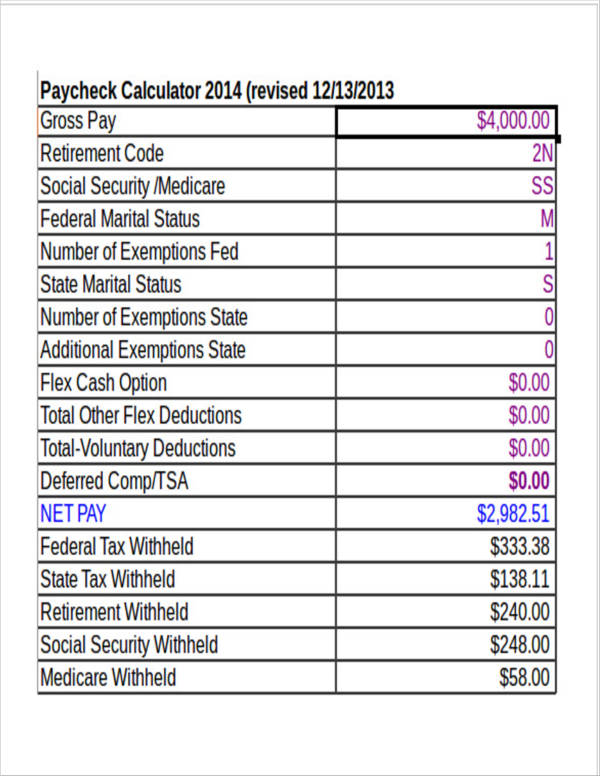

Pre-tax deductions taxes and additional deductions. Employers are also required to pay these workers an overtime rate of 15. In the steps that follow weve broken out deductions into three parts.

Exempt employees otherwise known as salaried employees generally do not receive overtime pay even if they work over 40 hours. The salary paycheck calculator can help you estimate FLSA-exempt salaried employees net pay. Bureau of Labor Statistics states that the average American works overtime for a little over 4 hours a week.

However if overtime is paid for time worked above 40 hours per week a carry-over system must be implemented. Hours Pay and Who is Covered. Use this calculator to quickly estimate how much tax you will need to pay on your income.

Converting that to an hourly rate - in case you were thinking of going contracting - is similarly straightforward but full of traps. We have another website dedicated to just the time card calculator that will round to your choice of decimal places. The Fair Labor Standards Act FLSA states that any work over 40 hours in a 168 hour period is counted as overtime since the average American work week is 40 hours - thats eight hours per day for five days a week.

In most cases the deadline for an employee working in Georgia to file a claim to recover unpaid overtime wages is 2 years. Free online gross pay salary calculator plus calculators for exponents math fractions factoring plane geometry solid geometry algebra finance and more. It is however important for employees to understand that the statute of limitations for unpaid overtime wage claims is a look back period meaning workers may only recover back pay for the 2 year period sometimes 3 years immediately preceding the filing of.

For each workday in the pay period open the corresponding day title and enter your In and Out times for that day. The net pay formula subtracts an employees gross pay from their paycheck deductions. Select overtime options and enter your pay rate if you want the final time card report to calculate your gross pay.

Overview of Federal Taxes When your employer calculates your take-home pay they will withhold money for federal and state income taxes and two federal programs. Formula based on OFFICIAL BIR tax tables. Therefore the time clock calculator will helpful for managing the working hours of employees.

An employee whose regular pay rate is 18 an hour worked 43 hours last week but work time was added to the payroll as 40 hours. Exempt means the employee does not receive overtime pay. Just fill the start time end time and break time in respective fields.

This free time card calculator generates weekly time reports based on provided work times and hourly rates. If overtime is paid for over 8 or 10 hours in a workday then overtime for semi-monthly pay is calculated the same as any other payroll timeframe. Employers only pay for working hours.

2022 Philippines BIR TRAIN Withholding Tax calculator for employees. Use Canstars 2022 Tax Pay Calculator to find out how much tax youll pay the Australian Tax Office ATO for FY2122 using your salary. How to calculate net pay.

Thats about 208 hours a year. Gross pay deductions net pay. To try it out enter the employees name and location into our free online payroll calculator and select the salary pay type option.

Follow the simple steps below and then click the Calculate button to see the results. If you work on a Bank Holiday the overtime increases to double your standard hourly rate.

Hourly Paycheck Calculator Calculate Hourly Pay Adp

Gross Pay And Net Pay What S The Difference Paycheckcity

Paycheck Calculator Take Home Pay Calculator

Paycheck Calculator Take Home Pay Calculator

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

Excel Busn Math 38 Gross Pay And Overtime 5 Examples Youtube

Free 12 Paycheck Calculator Samples Templates In Excel Pdf

What Is Annual Income How To Calculate Your Salary Income Income Tax Return Salary Calculator

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Free 6 Sample Net Pay Calculator Templates In Pdf Excel

Gross Pay And Net Pay What S The Difference Paycheckcity

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Hourly Paycheck Calculator Step By Step With Examples

Gross Pay And Net Pay What S The Difference Paycheckcity

8 Salary Paycheck Calculator Doc Excel Pdf Free Premium Templates

Overtime Calculator Workest

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy